In a few days, registered voters will be exercising a sacred right: to elect our country’s leaders for the next 6 years or so. I am not here to persuade you to vote for X, Y or Z, or to dissuade you from your almost made up minds.

I’m just here to remind us that yes, our elected leaders may play a part in either carrying us to the next stage of development, or back to being the sick man of Asia, but they can only do so much.

Like it or not, much of our better future still rests in our hands.

Governance

Yes, demand good governance, clean governance, political will, government with a heart, daang matuwid, better change, intelligent leadership, political will, accountability, better Philippines. When you vote, don’t vote for the personality, vote for the ideologies they are pushing. Vote for what you believe is right, for what you believe is best for the country, and for you. Vote for a better Philippines, vote for progressive change, vote for what’s best for your family, for your financial freedom.

The Man in the Mirror

It’s funny how we demand change in the government, and we have the right (and outrage) to do so. Yet, we tend to forget that lasting change doesn’t come from the top, it comes from the bottom, in our individual collective change. Remember Michael Jackson’s song? Let’s ask first the man in the mirror to make the change. Granted that we elect someone who has great character, who has the balls to discipline the country, but if we ourselves are not disciplined, do you think the President can police all of us? If we are not disciplined in obeying traffic laws, use of resources, obeying rules, securing our financial future, do you think the President can help us with that? Positive change starts in our backyards, not in the halls of Malacanang.

Born Poor vs Dying Poor

There’s a saying it’s not your fault if you were born poor, but it is your fault if you die poor. At this day and age, I’d say it’s 90% wrong to blame to government either if you die poor. Much of getting out of poverty lies in your hands, not in the governments hands.

If you can read this blog then it means you have internet access, you are English-literate, and probably have much better financial standing than recipients of 4Ps. You are leaning towards financial freedom, and not just mere survival. Your financial freedom is in your hands.

Now if you indeed belong to the poorest of the poor, homeless and jobless, then you really need government intervention to jumpstart your life to a better path. But then again, it only lasts for so long. Someday, you will have to stand on your own, fight for your own financial freedom with grit, ingenuity, perseverance and hope. The government will not give you everything. If you don’t think you don’t have enough financial muscle yet, then refrain from spending too much, from having too many children, from having vices, and buying wants, not needs. Refrain from getting married too early in life, finish your studies even if all your cousins are out of school to get married. Graduate then werk werk werk werk werk.

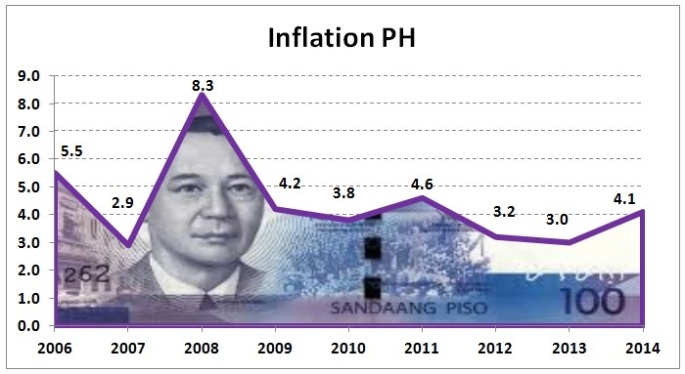

Ayala himself said, regardless of who wins the Presidency, our economy will continue to grow. Of course, if someone who has sound economics acumen and policies wins, then our economy might grow much faster. Might be felt by those in the provinces and countryside. But regardless who wins, our economy will grow, since our economy is not driven by the government, but by the private companies, by domestic consumption, by BPOs and OFW remittances, etc. We drive the economy. It will not be the end of the world whoever wins, but of course it will be good if Juan who wins is an enabler to a better Philippine economy.

Scarcity Mindset

Most Filipinos dream of a better life, yet a simple life. We don’t aspire for grand material wealth, just comfortable lives, a notch higher than just getting by, just surviving from paycheck to paycheck. Nothing wrong with this. However, some who have sort of settled for a simple life, have unknowingly settled as well for a scarcity mindset. That’s its enough that I live from paycheck to paycheck, that I have a job, that I don’t need to save, and the government will take care of me when I retire. Wake up!

While some feel that there’s never enough jobs, never enough income, never enough opportunities. Then blame the government for such scarcity. Yes the government is at fault for scarcity of wealth, opportunities and assistance etc for the poorest of the poor. But not for you, if you have access to this blog and money to pay for your internet. The government may be at fault for slow internet access, but if you don’t have savings and investments, is it still the government’s fault? If you don’t have savings yet you have internet and data plan, it is still the government’s fault?

Don’t think that money is the root of all evil. Worshipping money is evil, but money in itself is just a tool, an enabler. God wants us to have life, life to the fullest. God doesn’t want anyone to die poor, to suffer, God wants us to have financial freedom. The sooner you accept this, the sooner you find ways to fight for your own financial freedom, regardless of who sits in Malacanang.

Opportunities abound, and hopefully more if we elect the right leaders. But regardless of who wins, our financial freedom is our battle to win.

Vote for a better Philippines. Save. Pay your debts. Stay away from luho debt. Build passive income streams. Invest. Be financially free and help your countrymen to do the same, regardless of who sits in Malacanang.

Photo: “Philippines Grunge Flag” (CC BY 2.0) by Free Grunge Textures – www.freestock.ca