January is actually a good time as any to get started with your investments. We just prefer January and New Years since they are “new beginnings” so says the calendar. Why do we even need that outside “nudge” to tell us “Hey, it’s a new beginning, you might want to invest now”?

As they say, the best time to start investing is now. Most Pinoys say they do not invest due to lack of two things: knowledge and resources.

But I’d like to challenge that.

On knowledge, after 2015 of browsing Facebook and the web almost daily, have you gained a bit of additional knowledge in terms of investing? Was there any deliberate effort to learn? At this age of information technology, knowledge is really within our fingertips. It is up to us to reach out, to grab it. It must come from within.

On resources, was there any deliberate effort to free up resources: increase income and / or reduce expenses? Again, the key is to start, to begin, now, even with small amounts.

Start now.

Coins

Start with those coins in your pocket. Do you mindlessly spend them on trivial stuff? Why not put them in a coinbank?

Start Small

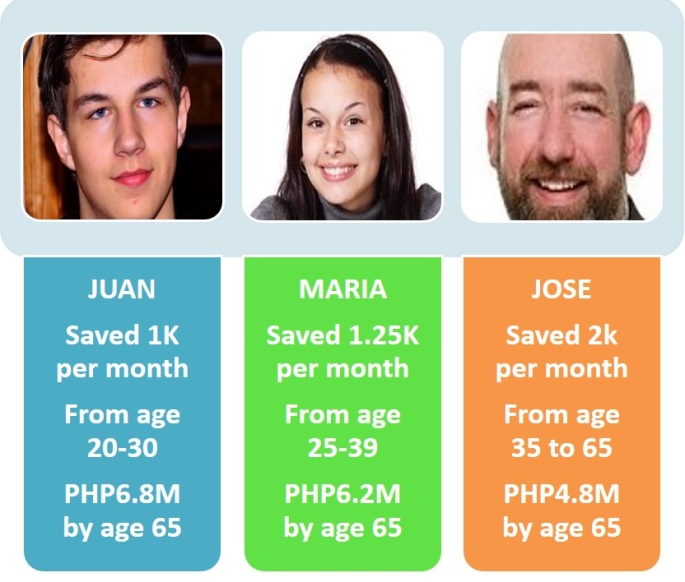

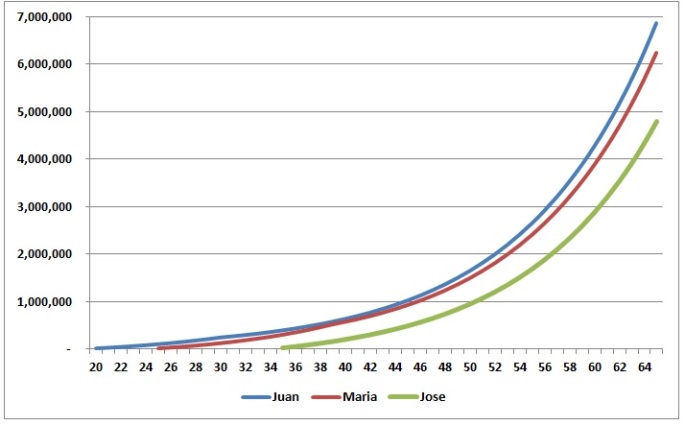

Key to Juan’s investments is starting small early on. It doesn’t have to be big, but preferably you start early on. This is what we have seen in the case of friends Juan, Maria and Jose.

Auto-Saver

Seek some help and do not rely on your own strong will to save regularly. Let others do it monthly or more frequently for you. Enroll your accounts to auto-debit arrangements such as EIP or Pag-Ibig MP2 or regular investment plans in COL Financial. It doesn’t have to be these providers, I’m sure your favorite bank or online broker have these.

Multiplier Effect

If you’re saving up for a family or other beneficiary, consider getting an insurance coverage. This will easily boost your savings for your beneficiaries in case something happens to you. Much faster than saving certain amounts on your own.

Track Your Progress

Track your net worth, not just your savings, not just your loans. You will never know if you’re progressing towards your financial goals if you don’t know where you are to begin with.

I’ll leave you with this encouraging quote:

May all Pinoys have a richer life!

Photo: Water Drops (74 of 83) (CC BY 2.0) by Soma Kondo