The Philippine Stock market made an impressive recovery to open 2017, but who knows if we have seen the bottom already or last week is just a dead cat bounce (given the lack of volume), a technical breather and we might see some further downside in the weeks to come. Who cares?

Either way, I’m okay, and I hope you are too. Sit tight! 2016 was harsh to those in the market for the short-term, especially months after elections, while for those who have very long-term O-H-A (objectives, horizon and appetite) such as me, 2016 was a chance to buy more from the market at lower levels.

While I mostly stayed in the sidelines for 2H16 after cashing in on the post-Duterte-election rally (I’ve learned to sell you know), my regular investment plans kept on buying for me, literally, regularly — multiple times a month.

I monitor my holdings regularly as part of my personal SALN and I want to share with you how two of my regular investment plans are doing: BDO Easy Investment Plan (EIP) (PSE: BDO) and my EastWest Bank PhilEquity Feeder Fund (PSE: EW) (or rather how they were battered during the downturn last year, and what it meant to me, if any). Note, I don’t advertise these banks but I endorse these investment products, whichever bank you get it from. I have holdings with other banks too but they are not fun to graph so anyway…

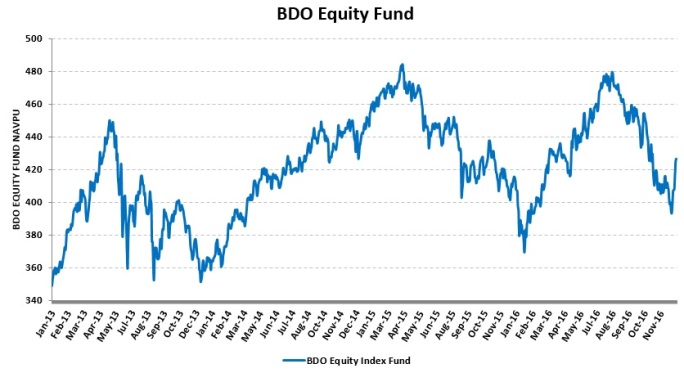

BDO EQUITY FUND

OHA: Retirement fund, 35 years from now (hopefully earlier), aggressive risk appetite

So I started this way back in 2013 (together with BDO Balanced Fund) and below is how the fund performed in almost 3 years. Quite a roller coaster ride really.

Published some previous updates on this way back in 2014 (When’s the Best Day to Buy Stocks? (Based on BDO EIP)) and I decided to have a look again given the harsh 2016. If you bought in Jan2013, then you would have been up as of today, but there are very few of us who can time the market (will you go all in then?), and not sustainably at that. Anyway…

The red dots below show my buying dates, previously enrolled every 15th, but given a salary increase, decided to buy every 15th and 30th starting Aug2015 (hence the more frequent dots). If 15th or 30th falls on a weekend / holiday, then buying date is the last trading day before it.

Glad to have brought some even when the market is down, and some more while it is severely down. That’s the benefit of regular investments, aside from cost averaging, it takes away the emotions, the fear (or the greed), you just keep buying. Otherwise, many would have been spooked with the market and stopped buying while it’s going down (fear). Conversely, many would have bought more and more while the market is doing very well (greed). With a regular investment plan, just buy and buy. Likewise, you don’t need to pay attention to it, they will just buy automatically for you, whether you remember it or not. It also acts as forced savings for you, until you develop the habit to really set aside an amount per month for investing. Below shows the moving average of my buying price:

As of Jan 6 market closing, my moving average (MA) is just slightly below the market price, hence a slight gain. But look at Mar14 to Apr15 and May16 to Aug16 segments. Those paper gains would have been amazing! But then again, I don’t mind. If the market is on its way to recovery, then I’m pretty excited about the upside (such as those segments I identified), but if not yet, then more chances to buy.

EASTWEST BANK PHILEQUITY FEEDER FUND

OHA: College tuition of kids, 16 to 18 years from now, aggressive risk appetite

So EastWest bank has this tie-up with PhilEquity fund where one of EW’s UITF tracks the performance of PhilEquity’s Equity Fund. Enrolled in this last 2015, buying every 10th and 25th. Here’s how the fund performed, as expected, not spared by the 2016 downtrend.

The next two graphs show the buying dates and the moving average.

As of Jan6, I’m still at a slight paper loss given my MA is still higher than market value. But the again, I don’t mind. The fund is still meant for 16 to 18 years from now.

FOR IMPROVEMENT

Sometimes, I buy an extra tranche when I feel like the market is oversold (I guess I’ve grown numb with the paralyzing market fear), but I do this with BPI whereas I don’t do anything when the market is zooming up. I’m also a work in progress with trading the ranges and more active trading, but I do this with my smaller stocks portfolio. As for my UITF (and investment portion of VUL), they will just keep on buying and growing this 2017. Let the experts do their jobs!

***

BDO data is from BDO website. EWB PEFF data is from uitf.com.ph. Again, not endorsing either banks, check with your preferred banks about their investment products. I have exposures in BPI and Security Bank too (in the spirit of disclosure).

Subscribe to our email newsletter by clicking below button:

Follow us on Facebook, Instagram and Twitter to learn more about various investment vehicles for every Juan. Join me in Truly Rich Club as well to have spiritual and financial abundance.

May you have a richer life!