If you’re reading this right now, then I assume you are ready to invest or at least trade stocks. Invest or trade, is there a difference? Yes there is.

If you’re still trying to figure out where to invest, then you should read this other post on where to begin. But if you say “stocks it is”, then a post on how to get started will be helpful. Once you’re more familiar of the jargons, basics, greater risks involved, etc. then you may proceed reading this post. Here I will discuss the easy steps how to post buy and sell orders.

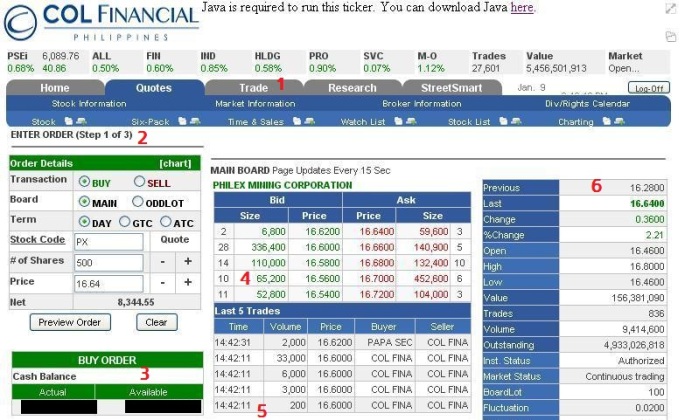

Will discuss COL Financial’s (PSE: COL) interface for now. You can read here if you’re using BPI Trade instead. There are many more online sites out there so please research.

- Click the ‘Trade‘ tab, then ‘Enter Order‘

- Input ‘Order Details‘

- Choose ‘Buy‘ or ‘Sell‘

- ‘Main‘ means your transaction is a multiple of required board lot. ‘Oddlot‘ means the number of shares in your transaction is lower or not a multiple of the required board lot

- ‘Day‘ means buy or sell order is good for the whole trading day, or until matched. ‘GTC‘ is good ’til cancelled so the transaction may be valid for a number of trading days until you decide to cancel it, or until it is matched. Useful if you have target prices that you think will be reached in the future. ‘ATC‘ means at the close or the transaction will be executed when trading is at closing phase.

- Enter the stock code, number of shares and the price. If you are selling, number of shares should be within number of shares owned.

- Pressing ‘Preview Order’ will show the summary of the transaction in the next page, plus all the fees to be charged. You are then required to key-in your password to confirm and to submit the transaction.

- Then you wait for your order to be accepted, posted then matched.

- This panel shows how much cash you have available for buying

- ‘Bid‘ shows demand volume/ buy requests per certain price while ‘Ask‘ shows volume of selling prices and the available volume for sale. The counts on the side are the nominal counts of the orders for both buy and sell. If your transaction has a matching price in the bid or ask, then chances are your order will be matched and executed. This is important for you to see the supply and demand.

- Shows last 5 matching trades, the time, volume of shares, at which matched price and the broker used to buy and sell. This is important for you to see the trend of the transactions, as well as who are the brokers doing the buying and selling

- This panel shows

- Previous trading day’s closing price

- Last transaction’s matched price

- Amount (last less previous) and percent Change for the day

- Opening price, Highest price and Lowest price for the day

- Value is the value of shares traded (sum of various volume x price)

- Trades is the number of matched trades for the day

- Volume is the number of shares traded for the day

- Outstanding is the number of shares issued by the company, used in computing earnings per share and P/E ratio

- Board Lot is the trading unit of the share which means the shares are sold per lot, or bundle or multiples of that lot

- Fluctuation is how much the price can go up or down per transaction. Also serves as guide when you set your buy or sell price

Other useful information:

Time and Sales

Shows all the trades executed (not just last 5) and at what time. Shows the trend within the trading day, the ups and downs and the volume.

Charting

Will show historical graphs, volume and other indicators useful in technical analysis and timing your entry

Watchlist

You can add here specific stocks to monitor so you don’t have to check on each stock one by one

Goodluck!

Thanks for finally writing about > “How to Buy PSE Stocks Online: COL Financial” < Loved it! my web blog :: cigarette electronique

LikeLike