Don’t mean to depress you this Yuletide season but let’s get this out of the way:

Juan doesn’t pay much attention to the cost of borrowing. He cares more on the monthly amortization (short-term thinking) rather than the total costs involved (longer-term thinking) And that costs Juan much.

Ouch.

Some of my strategies to avoid over-spending so much are as follows:

- I maintain just 2 credit cards and leave one behind so I don’t get to use it.

- I track not just my savings and investments, but more importantly my loans and card balances. Tracking these two effectively allows me to track my financial net worth. This doesn’t have to be technical as long as it serves your overall purpose.

- I compute for total interest expense before availing of a loan. Not just the amortization.

I’d like to share more on this part via this post.

It’s true that credit and loans can give us leverage, a lift, increased financial power and capacity compared to spending years and years to save up and make major, as in major purchases.But like all powers, it must be used responsibly.

The usual marketing strategy of loan providers (banks, credit cards) is to highlight the monthly amortization of such loans, that way Juan can easily “see” whether s/he can afford the monthly repayments.

“Ma’am, at PHP6,800 a month, you can borrow PHP300,000 already, payable for 60 months”, said one teleagent.

Mathematically, if you save 6,800 a month, it will take you around 45 months to save a total of PHP300,000. But here, you can get it in lump sum in a few days time as long as you can repay PHP6,800 a month. Nice eh?

There’s nothing wrong with this. But that’s not the whole picture. In fact, loan providers are actually required to give their borrowers a loan repayment schedule wherein the monthly payments are broken down as to how much goes to principal and to interest payments. The problem is we don’t read it, we don’t compute or we just don’t care.

At some point in our lives, we will have to avail of loans. It can’t be avoided, and some times we’re really at the mercy of loan providers. But the minimum we can do, aside from check whether we can afford the amortization, is to shop not for the lowest amortization, but the lowest rates we can find.

Consider the following realities:

Note that processing fees, pretermination fees, documentary stamp tax, etc etc are not yet included here.

As for the condo unit with parking, that property will probably register in your

personal SALN as PHP3M assets (plus some market appreciation if you wish) then PHP2.4M mortgage loan. But behind this, you have to shell out PHP4.1M just to pay for the PHP2.4M loan. Depressing? I didn’t mean to.

The point us, before diving in a loan, consider how much it will cost you. I’m not paid to advertise this but the following Android app comes very handy in computing for above. It is among the most used apps in my phone.

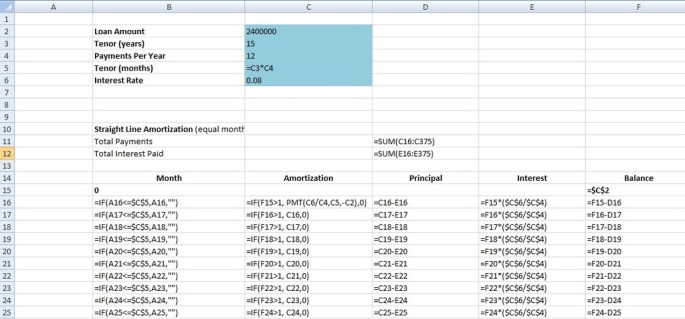

Or re-create below loan amortization table in Excel. Provided the formula below:

Or at the very least please ask for the loan amortization schedule from your financial institution.

Subscribe to our free email newsletter to get personal finance articles like this. Just key in your email below and wait for your confirmation email. May you have a richer life!

Thank you too for your interest!

Here's the link:

http://www.investmentjuan01.com/2015/12/true-cost-of-borrowing-we-dont-care-straight-line-diminishing-balance-amortization.html#more

Of if you can't click it, look for the Dec 1 2015 article.

LikeLike

True! The nerd part of me also monitors my debt to equity ratio as long as my short-term loans. Just being OC as corporate-y on how I handle my finances.

LikeLike

Thanks for this. Very useful. Could you also share the excel formulas for Diminishing Balance Amortization?

LikeLike

I like this one.

Pay P20,000 (over 2 years) for this P15,000 item sounds a LOT different from “JUST P834 a month!”

“Living below your means” is NOT “Keep your credit payments a little less than your income.”

LikeLike